net investment income tax brackets 2021

Tax Rate for Entity Fiscal Year 2020-2021. Some interest income is tax-exempt though.

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

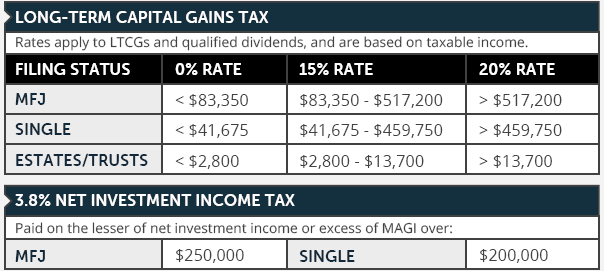

For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income.

. 83350 for married couples filing jointly. There are five marginal tax brackets of 2 6 10 and 14 and 17. Your bracket depends on your taxable income and filing status.

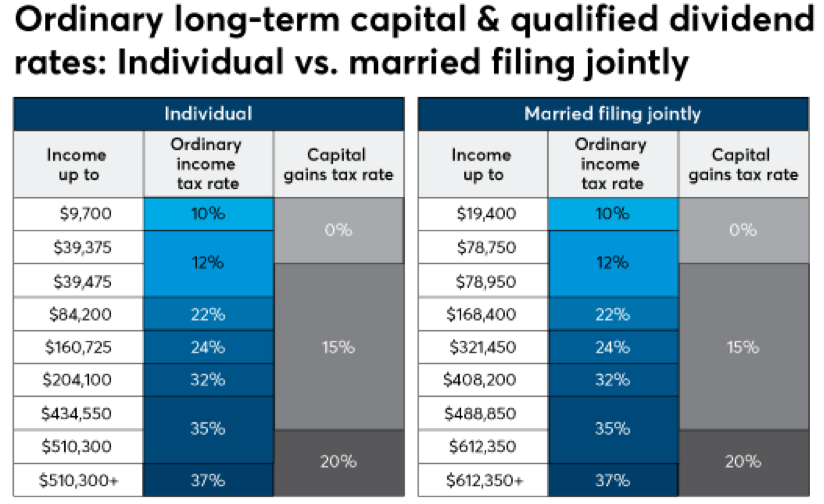

10 of taxable income. The 12 rate would be applied to your income that falls between 9950 and 40525 and the 10 rate is applied to. There are seven federal tax brackets for the 2021 tax year.

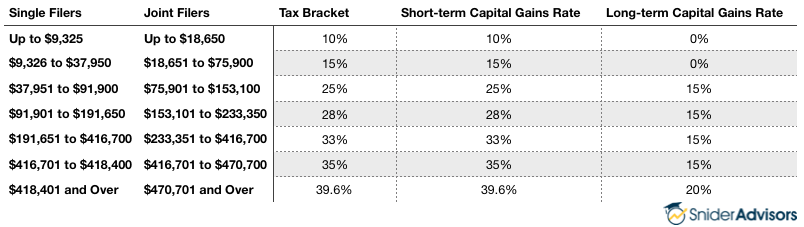

Net investment income includes interest dividends annuities royalties certain rents and. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income. 10 12 22 24 32 35 and 37.

The tax rate a homeowner must pay depends on their taxable income. Which the highest income tax bracket applicable to an estate or trust begins. 26 tax rate applies to income at or below.

The NIIT is equal to 38 of the net investment income of individuals estates and certain trusts. In addition to these rates a 38 net investment income tax is assessed on the capital gains of high earners regardless of whether they are long- or short-term in nature. Net investment income tax brackets 2021.

There are five PAYE tax brackets for the 2021-2022 tax year. The net investment income tax is a 38 surtax that is paid in addition to regular income taxes. 10 12 22 24 32 35 and 37.

Those rates range from 10 to 37 based on the current tax brackets. For 2021 the highest income tax bracket applicable to an estate or trust begins at 13050. 2020 Tax Brackets Due April 15 2021 Tax rate Single filers Married filing jointly Married filing separately Head of household.

For 2020 it was. A married couple with a net investment income of 240000 and modified adjusted gross. For the tax year 2021 youd pay 22 on income over 40525.

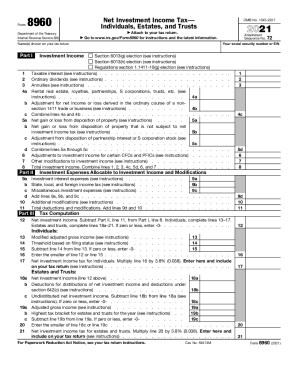

Multiply line 16 by 38 0038. There are seven brackets. Between 4950 and 7400 with a maximum out-of-pocket expense maximum for family coverage of 9050 for 2022.

Your capital gains rate is 0 for the 2022 tax year provided your income does not exceed. How much you will. Tax Rate for Natural Person Fiscal Year 2020-21.

What is the Net Investment Income Tax Rate. But not everyone who makes income from their investments is impacted. For a decedent dying in 2021 the exemption level for the.

Federal income tax rate. These brackets are marginal which means that different portions of your income up to a specified dollar. 41675 for married couples filing separately.

10 on taxable income. Enter here and include on your tax return see instructions. In general net investment income for purpose of.

According to data from the IRS the tax rate on most net. 1990 12 on the amount over 19900. The net investment income tax NIIT is a 38 tax on net investment income such as capital gains dividends and rental and other income after allowable deductions to the extent.

These are the rates for. Tax rate Taxable income bracket Tax owed. Net investment income tax for individuals.

Finance minister Tito Mboweni has outlined the new tax brackets for personal income taxpayers in his Budget speech 2021 on Wednesday 24 February.

9 Common Questions About Investment Income Tax

What Is The Net Investment Income Tax Caras Shulman

2021 2022 Long Term Capital Gains Tax Rates Bankrate

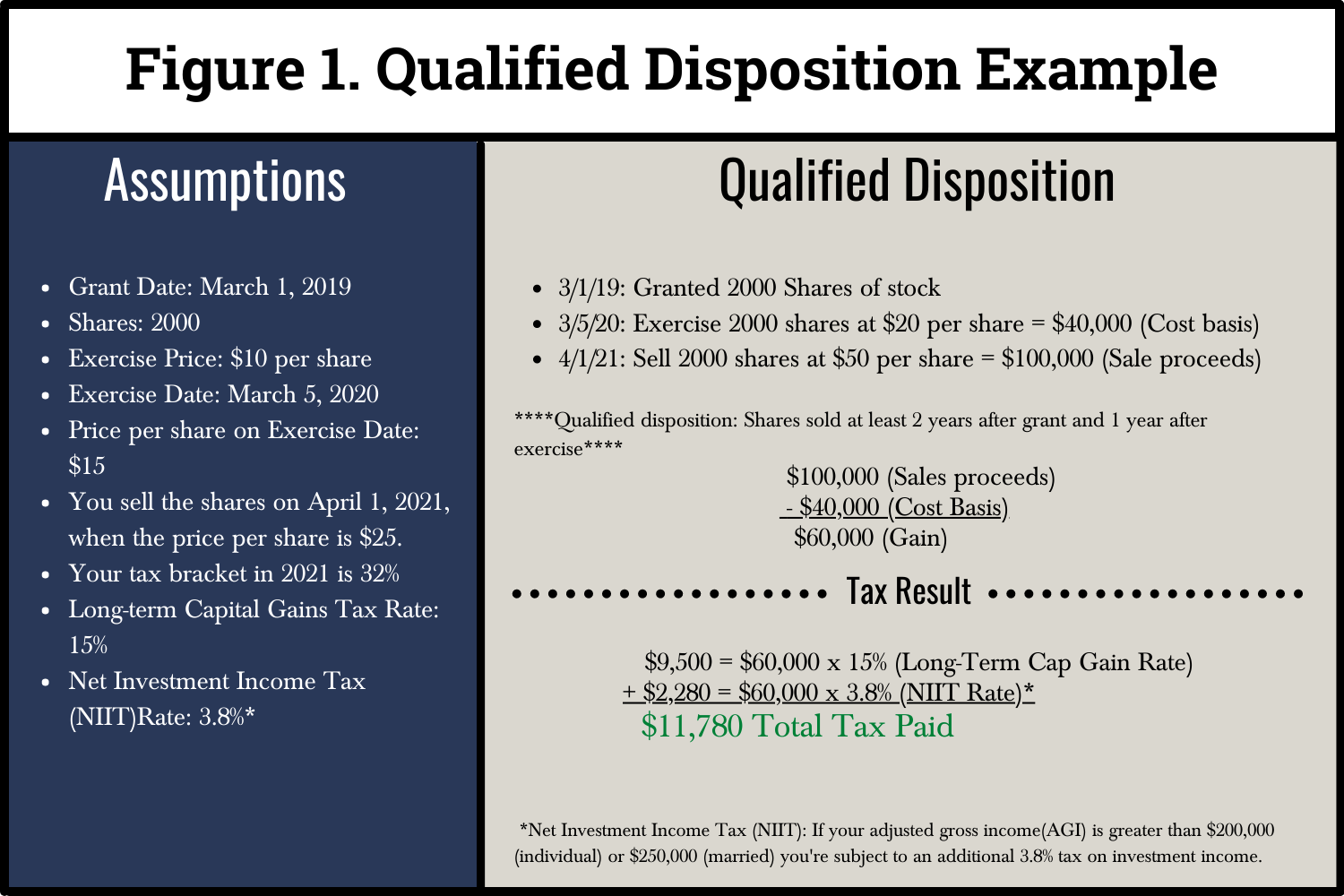

Evaluate Your Iso Strategy To Create Value And Save Taxes

How Much Tax Do You Pay When You Sell A Rental Property

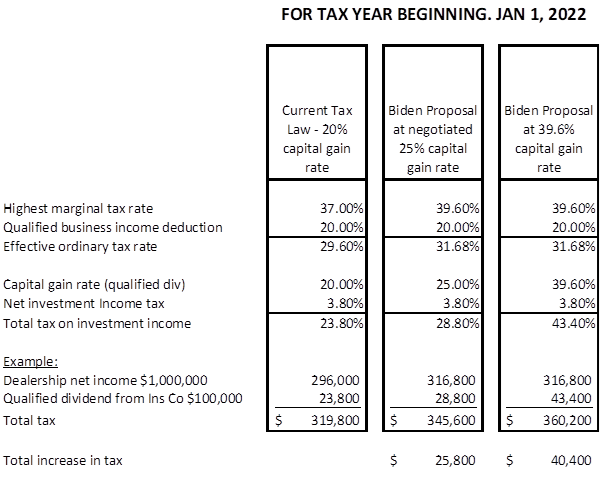

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

The Future Of Captive Reinsurance Companies Under The Biden Tax Plan Withum

Net Unrealized Appreciation Fpog Podcast Episode 2

Capital Gains Tax What Is It When Do You Pay It

Build A Tax Efficient Taxable Account As A Physician Wealthkeel

What Is The Net Investment Income Tax And Who Has To Pay It Bankrate

Consider Taxes In Your Investment Strategy Rodgers Associates

Year End Tax Planning For Biden Tax Plan

Wealthfront Tax Loss Harvesting Wealthfront Whitepapers

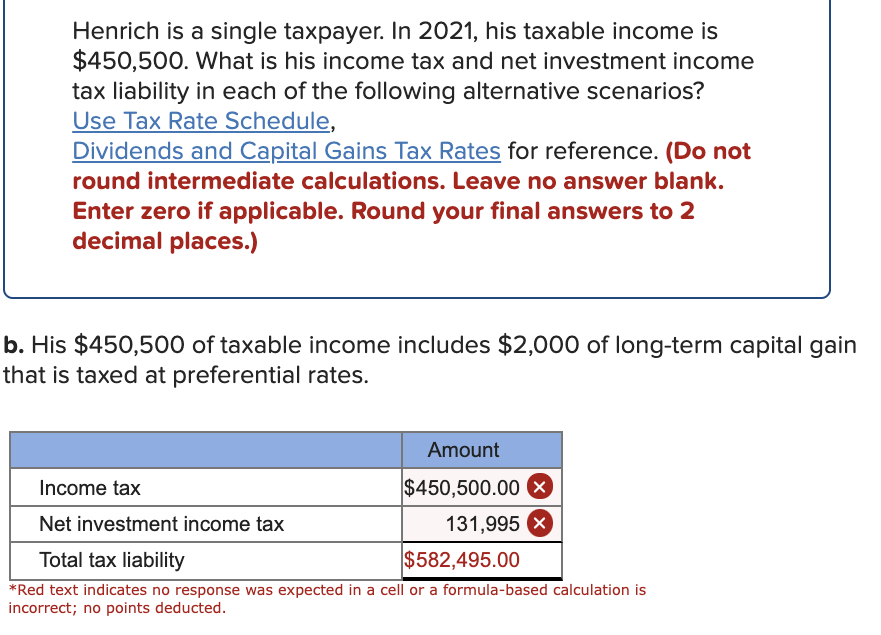

Solved Henrich Is A Single Taxpayer In 2021 His Taxable Chegg Com

Form 8960 Instructions 2021 Fill Out And Sign Printable Pdf Template Signnow

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Helpful Information For Filing 2020 Income Taxes And Proactive Tax Planning For 2021 Capital Income Advisors